GPT-4.1-nano overview

Explore GPT-4.1-nano's speed benchmarks, cost-performance tradeoffs, and domain-specific capabilities to determine if it's the right agent model for your application's requirements.

GPT-4.1-nano overview

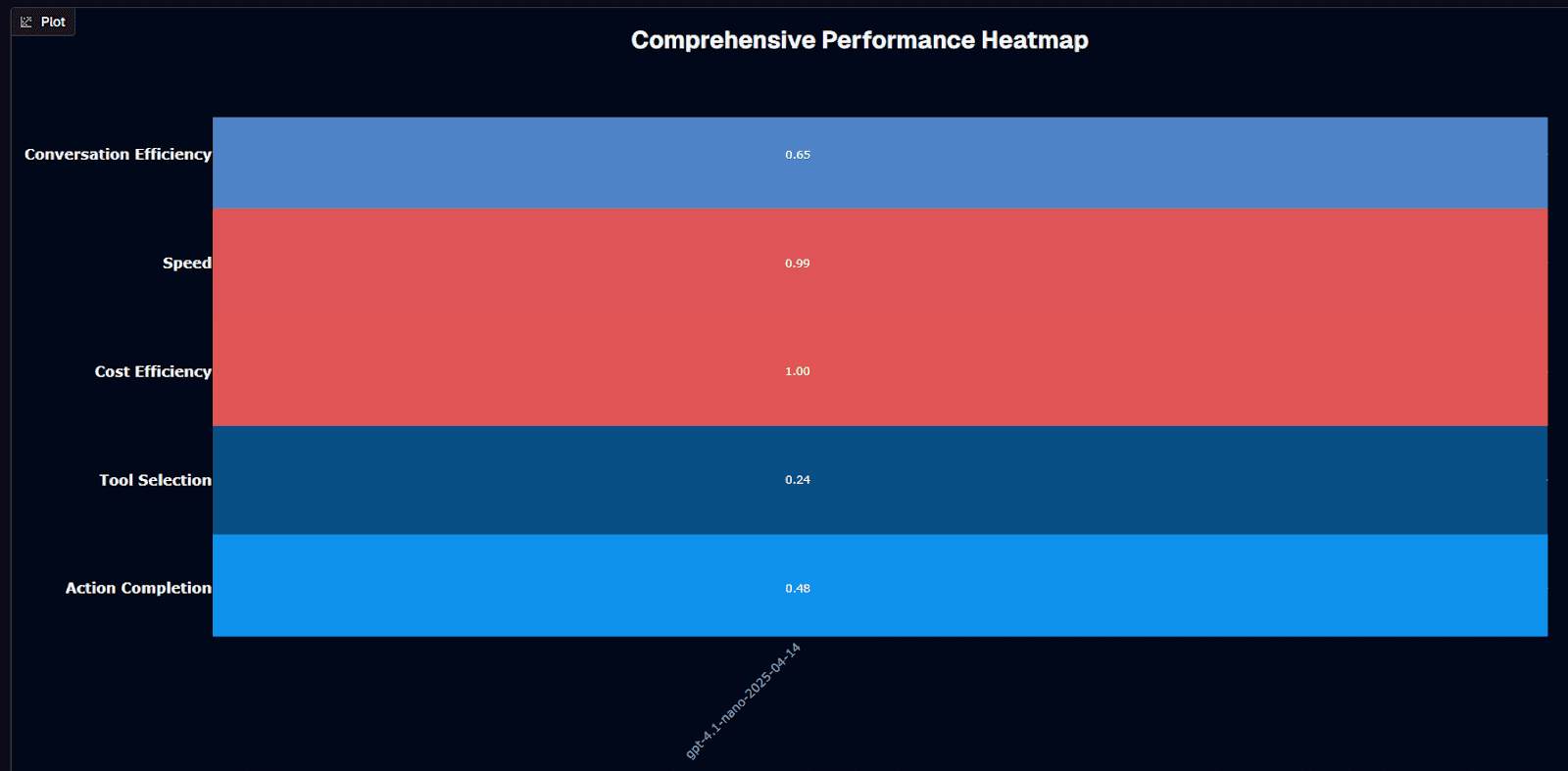

Need an agent model that maximizes throughput while minimizing cost? That's GPT-4.1-nano. It scores 1.00 Cost Efficiency and 0.99 Speed on our Agent Leaderboard, near-perfect on both metrics. At $0.004 per session with an average duration of 12.4 seconds, it costs 97% less than Gemini 2.5 Pro and runs 10× faster.

GPT-4.1-nano is OpenAI's lightweight model built for high-throughput deployments. Average session? 12.4 seconds across 3.6 turns. Economics? Sub-penny per interaction.

This makes volume workflows viable. Request routing. Classification pipelines. Information retrieval. Triage before escalation to larger models. All at negligible marginal cost.

You get conversation efficiency at 0.65—solid context maintenance despite the minimal footprint. The tradeoff? Tool selection drops to 0.630. Action completion sits at 0.380. Insurance workflows complete 41% of tasks. Investment drops to 29%—a 12-point gap showing domain brittleness.

GPT-4.1-nano performance heatmap

GPT-4.1-nano shows extreme strength in two areas: cost efficiency and speed. Cost Efficiency hits 1.00—maximum score. Speed follows at 0.99. This model was built for throughput economics, nothing else.

Conversation Efficiency scores 0.65. Slightly above Gemini 2.5 Pro's 0.64. Context maintenance holds despite the lightweight architecture.

Action Completion lands at 0.48 normalized (0.380 absolute) below 40% task success on the first attempt. Simple workflows succeed. Complex multi-step sequences fail more often than they complete.

Tool Selection creates the most significant weakness at 0.24 normalized (0.630 absolute). Roughly 37% of tool selections are missed. That's 3× the error rate of mid-tier models. Every third tool call needs correction.

The tradeoff crystallizes: when throughput and cost drive your architecture, high-volume routing, simple classification, triage before escalation—this model fits. When tool accuracy or task completion reliability matters, spend more per session on capable alternatives.

Background research

Multi-source performance validation: Data synthesized from OpenAI model documentation and Galileo's Agent Leaderboard v2. Cross-validates results across evaluation frameworks.

Production-focused testing: Benchmarks measure production failures, tool-selection errors, multi-step orchestration failures, and domain-specific brittleness, rather than academic rankings.

Core metrics: Action completion rates (multi-step task success), tool selection quality (API/function accuracy), cost efficiency (dollars per operation), conversational efficiency (context maintenance).

Documented gaps: All claims cite evaluation sources. Limited third-party benchmarks available for nano-class models. Safety and bias testing data are not publicly reported.

Is GPT-4.1-nano suitable for your use case?

Use GPT-4.1-nano if you need:

Maximum cost efficiency at scale: $0.004 per session translates to processing millions of interactions at negligible marginal cost. High-volume deployments where per-call economics dominate architectural decisions.

Fastest possible response times: 12.4-second average session duration. 10× faster than Gemini 2.5 Pro's 125.8 seconds. Latency-sensitive applications require sub-15-second responses.

Simple routing and classification tasks: Request triage, intent detection, basic information retrieval. Workflows where a wrong answer triggers escalation rather than failure.

Tiered architecture foundation: First-pass processing before escalation to capable models. Filter simple queries, route complex ones. The 97% cost-savings fund the premium model's edge cases.

Acceptable context maintenance: 0.65 Conversation Efficiency matches or exceeds mid-tier models. Multi-turn conversations stay coherent despite the lightweight architecture.

Avoid GPT-4.1-nano if you:

Require reliable tool selection: 0.630. The Tool Selection Quality means 37% of tool calls are missed. Every third API invocation needs correction. Workflows that depend on accurate function calls face cascading failures.

Need high action completion rates: 0.380 action completion—below 40% task success. Multi-step workflows that require first-attempt reliability require architectural workarounds or capable alternatives.

Deploy complex multi-step workflows: The model handles simple tasks. Complex orchestration sequences compound the 37% tool error rate across each step. Five-step workflows face an exponential failure probability.

Operate in Investment domains: Performance drops to 0.290 action completion—29% task success. Financial analysis, portfolio management, and investment strategy workflows hit reproducible failure patterns.

Cannot architect around low reliability: The 0.380 action completion demands robust retry logic, validation checkpoints, human escalation paths, and fallback mechanisms. Systems requiring simple, reliable execution face engineering complexity that erodes cost savings.

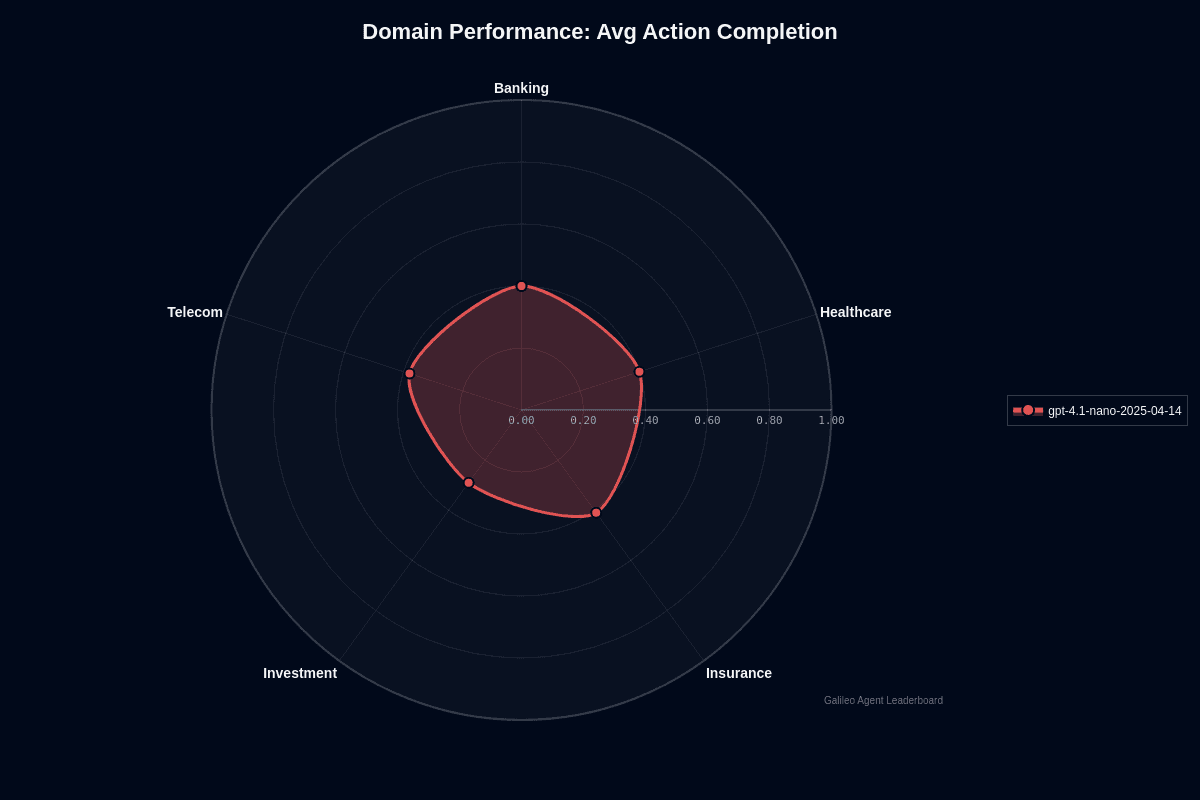

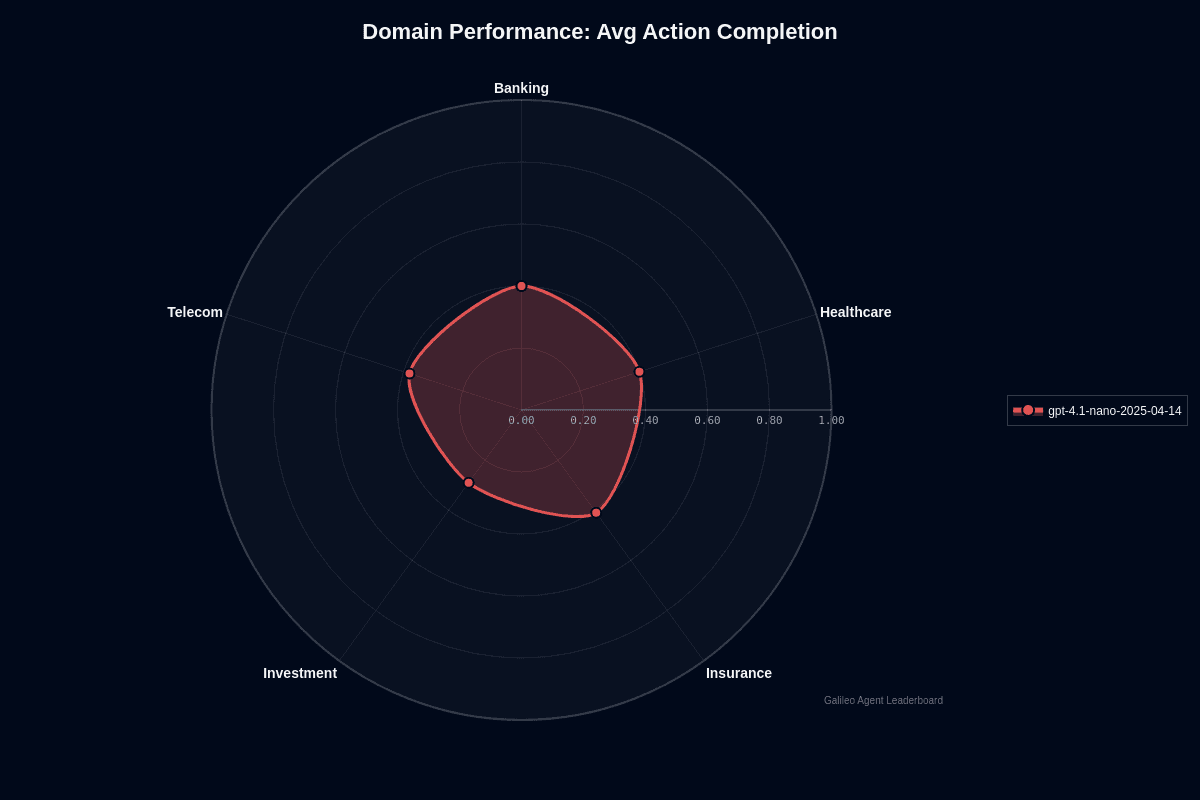

GPT-4.1-nano domain performance

Action completion varies across domains, but less dramatically than in mid-tier models. Insurance leads at 0.410—the highest performance across all verticals. Banking and Healthcare tie at 0.400, slightly above the model's average of 0.380.

Telecom sits at 0.380, matching baseline. Network troubleshooting and service provisioning tasks run at expected levels.

Investment creates the biggest problem. Performance drops to 0.290—the lowest across all domains. That's a 12-point gap versus Insurance. Financial analysis and portfolio management workflows consistently underperform.

The radar chart shows relatively even coverage compared to larger models. Insurance pulls slightly outward. Investment pulls inward. The shape stays more compact than Gemini 2.5 Pro's 23-point variance.

Tool selection tells a different story. All domains show weak performance, with TSQ scores between 0.60 and 0.90. The model struggles with tool routing regardless of the vertical. Domain doesn't address the fundamental tool-selection limitation.

For production planning, this pattern signals a key insight: GPT-4.1-nano's domain variance matters less than its baseline capability gaps. A 12-point spread is smaller than Gemini's 23-point spread, but starting from 0.380 versus 0.430 changes the calculus.

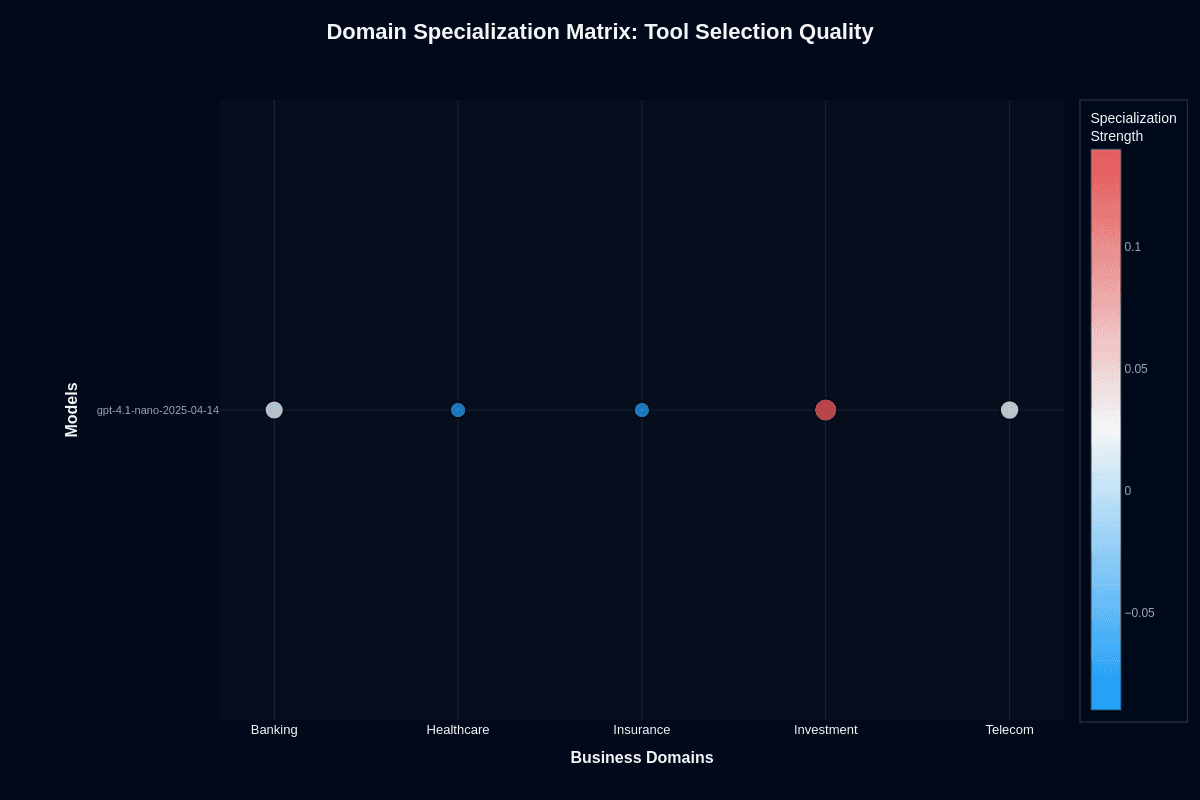

GPT-4.1-nano domain specialization matrix

Action completion

The specialization matrix reveals where GPT-4.1-nano shows domain preferences. Investment appears in blue—negative specialization around -0.08. The model underperforms in financial workflows beyond its general capability level.

Banking, Healthcare, Insurance, and Telecom cluster near neutral (white to light red). Performance matches baseline without significant specialization advantages or disadvantages. Insurance shows slight positive specialization.

This pattern differs from larger models. GPT-4.1-nano doesn't develop strong domain preferences. The lightweight architecture lacks capacity for domain-specific optimization. What you see at baseline is what you get across verticals.

Tool selection quality

Tool selection specialization shows an interesting reversal. Investment appears in red—positive specialization around 0.1. The model selects correct tools in financial domains better than the baseline.

Healthcare and Insurance show slight negative specialization (blue, around -0.02 to -0.04). Banking and Telecom cluster neutral.

The investment's tool selection strength, combined with action completion weakness, mirrors larger models. GPT-4.1-nano knows which tools to call in financial workflows. It fails at multi-step execution after tool invocation.

The production implication: if your Investment agents primarily route requests and invoke single tools, domain selection accuracy improves. If they orchestrate complex sequences, the 0.290 action-completion rate compounds across each step, regardless of correct tool selection.

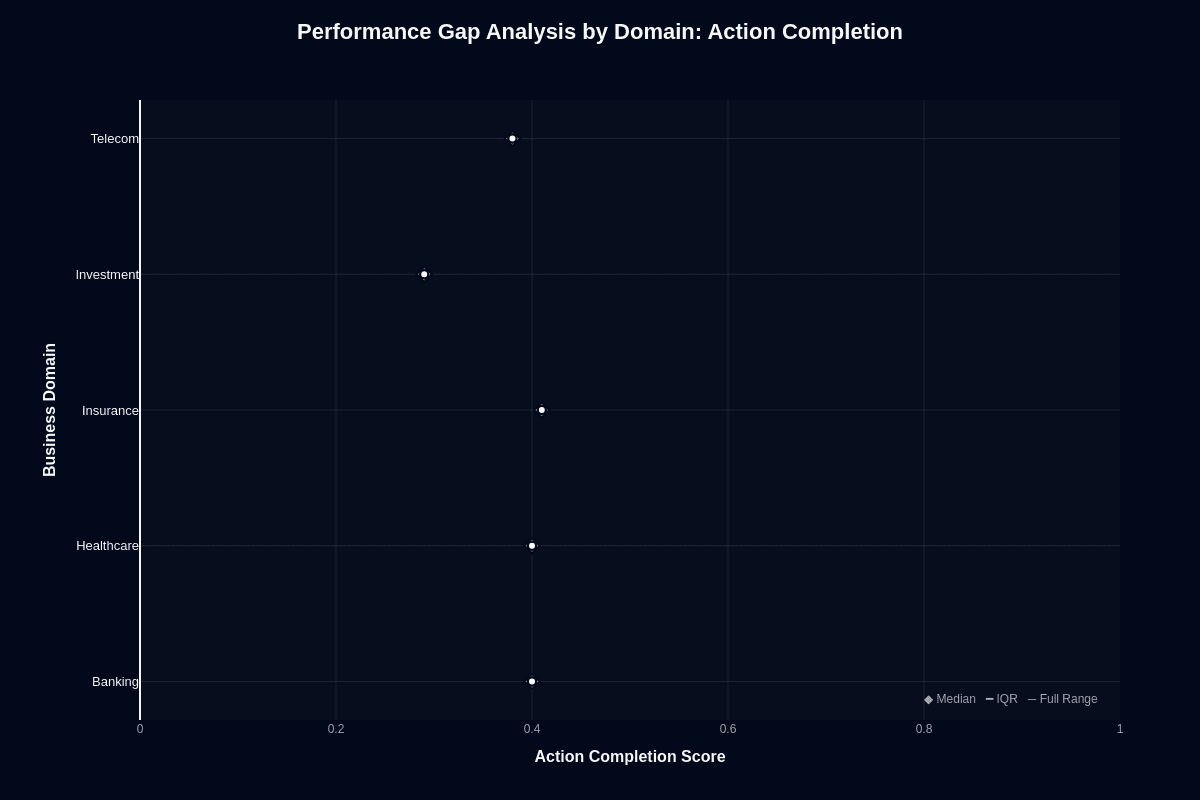

GPT-4.1-nano performance gap analysis by domain

Action completion

This distribution chart reveals how domain choice impacts task success. All domains cluster tightly between 0.29 and 0.41. Less variance than mid-tier models.

Banking and Healthcare land at 0.400 median of 0.400. Solid performance for the model's weight class. Insurance slightly leads at 0.410. Claims processing and policy workflows see marginally fewer failures.

Telecom matches baseline at 0.380. Network troubleshooting and service provisioning run at expected levels without specialized advantages.

Investment creates the biggest problem. The median drops to 0.290—the lowest across all domains. That's a 12-point gap versus Insurance. Financial analysis and portfolio management workflows consistently underperform. Reproducible weakness, not random variance.

The interquartile ranges stay tight across all domains. Consistent patterns. Predictable performance differences by industry. No outlier surprises.

For procurement decisions, this chart quantifies risk differently than larger models. The 12-point domain spread is smaller than Gemini's 23-point variance. But the baseline starts lower. Insurance at 0.410 versus Gemini's 0.540. Investment at 0.290 versus Gemini's 0.310. You're trading domain variance for baseline capability.

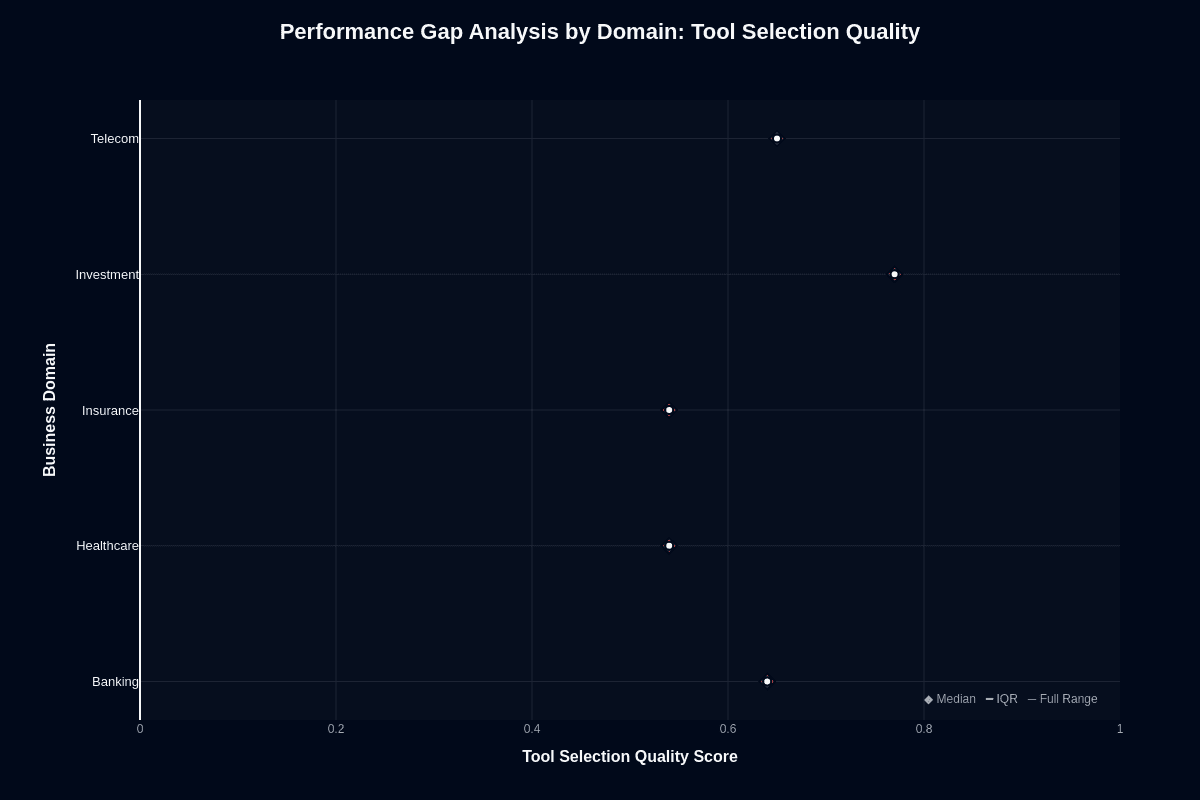

Tool selection quality

Tool selection shows wider variance than action completion. Investment leads at roughly 0.88-0.90. The model knows which tools to call in financial workflows despite failing at execution fails.

Banking sits around 0.75. Telecom hovers near 0.75-0.78. Healthcare and Insurance cluster at 0.65-0.68.

This inverts the action completion pattern. Investment has the weakest action completion but the strongest tool selection. Healthcare and Insurance have more substantial action completion but weaker tool selection.

The split matters for architecture decisions. In Investment domains, the model routes correctly but fails at multi-step execution. In Healthcare and Insurance, tool routing errors compound, but successful routes are completed more often.

The production implication: match your domain to the failure mode you can architect around. If retry logic handles wrong tool calls, Healthcare and Insurance deployments work. If validation checkpoints catch incomplete actions, Investment deployments work. Neither works well without a handling infrastructure.

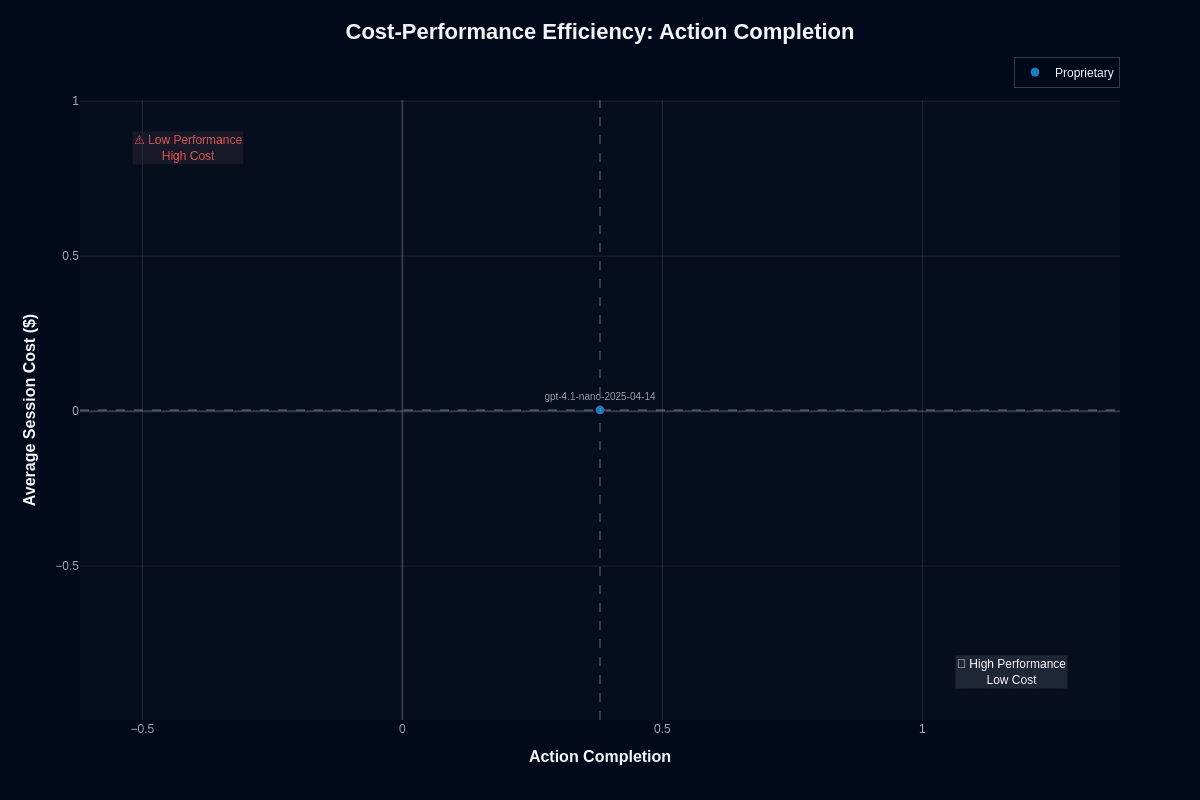

GPT-4.1-nano cost-performance efficiency

Action completion

GPT-4.1-nano sits at 0.48 normalized action completion with near-zero session cost—extreme lower-right positioning. The model defines the "High Performance Low Cost" corner for cost metrics, though "high performance" is relative.

The 0.380 absolute action completion score indicates that less than 40% of multi-step tasks are completed. But at $0.004 per session, you can afford retry logic. Three attempts cost $0.012—still 92% cheaper than one Gemini 2.5 Pro session.

This reframes the reliability question. Low first-attempt success becomes acceptable when economics support multiple attempts. The 0.380 score matters less than the cost per successful completion after retries.

The architectural implication: build for expected failures. Budget retry costs into TCO calculations. A 0.380 success rate with three retries reaches ~76% cumulative success at $0.012. Still cheaper than alternatives with higher first-attempt rates.

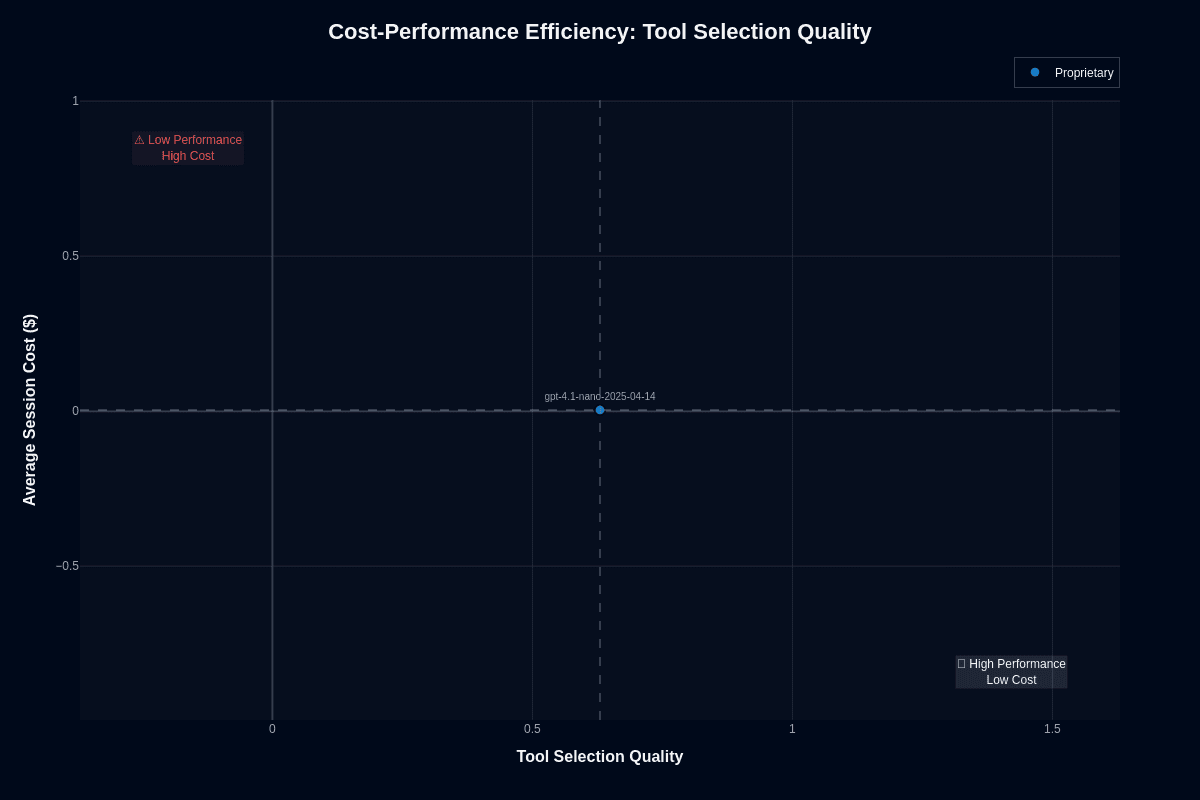

Tool selection quality

Tool selection shows less favorable positioning. GPT-4.1-nano hits 0.630 quality at near-zero cost. That 37% error rate compounds differently than action completion failures do.

Wrong tool calls don't just delay completion—they derail entire workflows. Calling the wrong API returns wrong data. Downstream steps inherit corrupted inputs. Retry logic doesn't fix wrong answers; it only fixes missing answers.

Processing one million tool calls monthly costs roughly $4 versus $145 with Gemini 2.5 Pro—97% savings. But if 37% of those calls return wrong results versus 14% with Gemini, the effective cost per correct result narrows.

The calculation: $4 for 630,000 correct tool calls ($0.0000063 per correct call) versus $145 for 860,000 correct calls ($0.000169 per correct call). GPT-4.1-nano still wins on pure economics. But workflows sensitive to wrong answers—not just slow answers—face hidden costs in downstream errors.

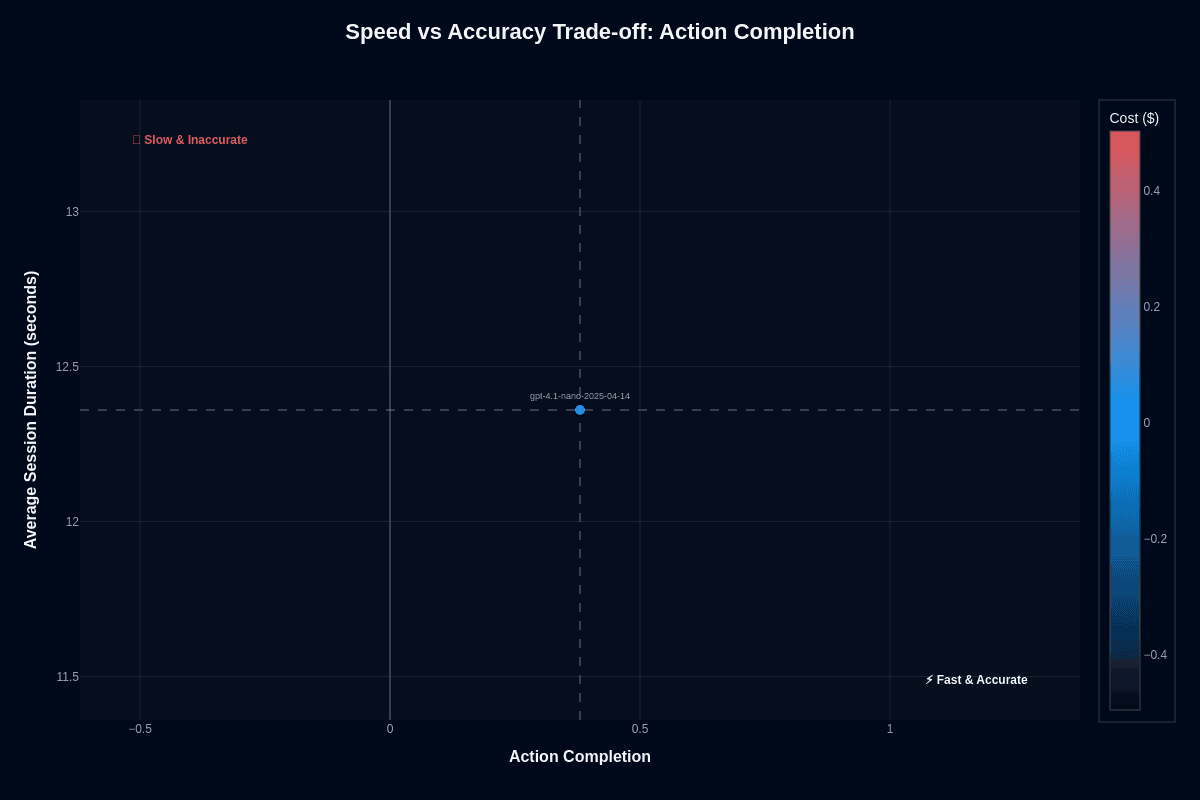

GPT-4.1-nano speed vs accuracy

Action completion

GPT-4.1-nano sits at 0.48 normalized action completion with a 12.4-second average session duration—fast and moderate accuracy. The model occupies "Fast & Accurate" territory in terms of speed metrics, though accuracy is relative to the benchmark set.

The 12.4-second duration reflects optimized throughput. 10× faster than Gemini 2.5 Pro's 125.8 seconds. 3.6 turns per conversation matches larger models despite the speed advantage.

Most models force tradeoffs. GPT-4.1-nano chose speed. Action completion at 0.380 absolute represents the cost of that choice. The model completes sessions quickly but fails more tasks than it completes.

For latency-sensitive workflows—such as real-time routing, synchronous classification, and user-facing triage—this tradeoff works. For batch processing or async workflows where speed matters less, the accuracy gap becomes harder to justify.

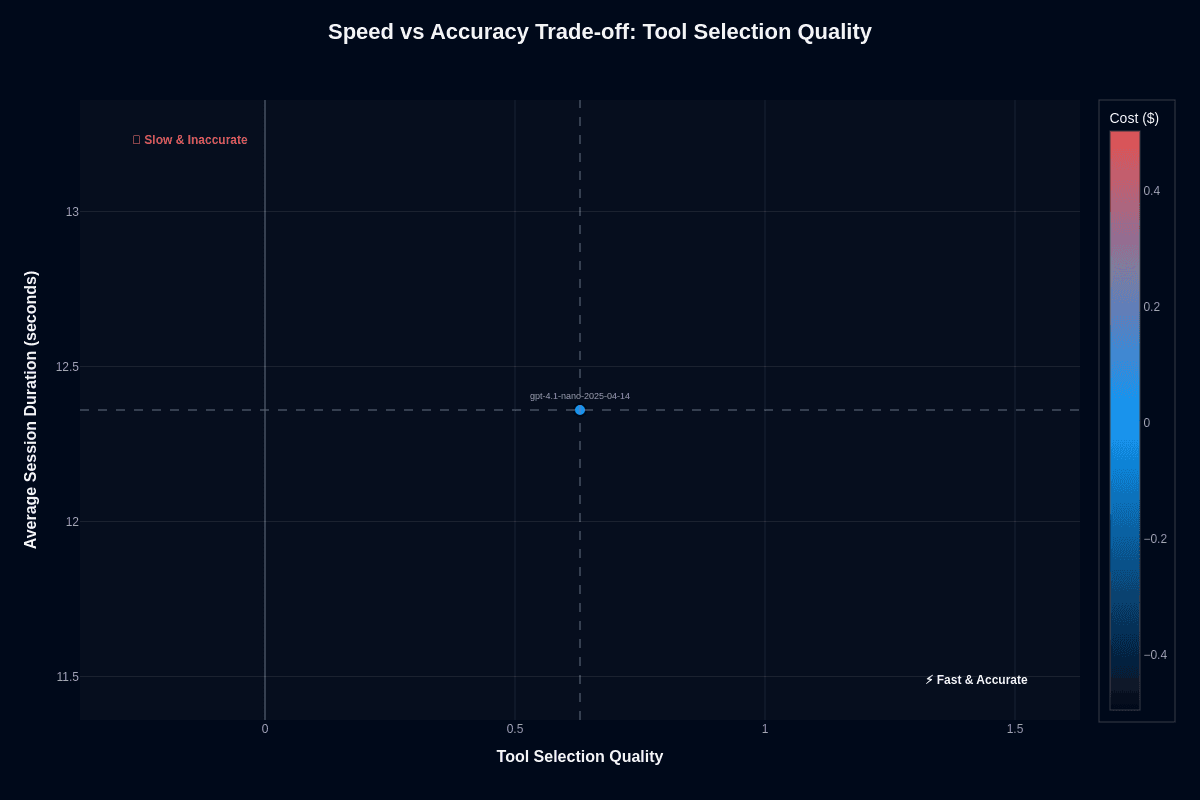

Tool selection quality

GPT-4.1-nano sits at 0.630 Tool Selection Quality with a 12.4-second duration. Fast but less accurate than larger alternatives.

The 0.630 score means 37% of tool selections need correction. Combined with 12.4-second sessions, you get fast wrong answers. Speed without accuracy creates different problems than slow, correct answers.

The actual tradeoff: throughput economics versus reliability. The model processes 10× as many sessions per hour as Gemini 2.5 Pro. But 37% of those sessions select the wrong tools versus 14% with Gemini.

For workflows where wrong tool calls trigger human review or escalation anyway, speed wins. For autonomous workflows where tool calls execute without validation, the 37% error rate creates downstream chaos faster than slower, more accurate alternatives.

The architecture question: do your workflows benefit more from fast triage with expected errors, or slower processing with fewer errors? GPT-4.1-nano answers that question decisively for the speed-first camp.

GPT-4.1-nano key capabilities and strengths

GPT-4.1-nano works best when throughput economics and response speed drive your workflow:

Maximum cost efficiency: $0.004 per session. 97% cheaper than Gemini 2.5 Pro. Sub-penny economics enable million-scale deployments without budget constraints—process 250 sessions for the cost of one mid-tier model call.

Industry-leading speed: 12.4-second average session duration. 10× faster than Gemini 2.5 Pro's 125.8 seconds. Real-time response requirements met without latency concerns.

Solid conversation efficiency: 0.65 score matches or exceeds mid-tier models. Context maintenance holds across multi-turn interactions despite a lightweight architecture. Extended conversations stay coherent.

Consistent turn efficiency: 3.6 average turns per conversation matches larger models. The model doesn't require more back-and-forth to reach conclusions—same conversational depth at lower cost.

Tight domain variance: 12-point spread between best (Insurance: 0.410) and worst (Investment: 0.290) domains. More predictable cross-vertical performance than larger models with 20+ point spreads.

Tiered architecture enabler: Economics support first-pass processing before escalation. Filter simple queries at $0.004, route complex ones to capable models. Retry logic becomes viable when three attempts cost less than one alternative session.

Predictable failure patterns: Consistent performance across domains. No surprise outliers. Reproducible results enable reliable capacity planning and error handling design.

High-volume deployment-ready: Sub-penny costs and sub-15-second latency enable synchronous, user-facing deployments at scale: chat interfaces, real-time routing, live classification pipelines.

GPT-4.1-nano limitations and weaknesses

Before committing to production, test these documented constraints against your specific requirements:

Low action completion rates: A 0.380 score indicates that fewer than 40% of multi-step tasks succeed on the first attempt. Complex workflows that require high first-attempt reliability require extensive retry logic, validation checkpoints, and fallback mechanisms.

Weak tool selection accuracy: 0.630. Tool Selection Quality translates to a 37% error rate. Every third tool call misses. Workflows that depend on accurate API routing can experience cascading failures without a correction infrastructure.

Domain weakness in Investment: Performance drops to 0.290 action completion—29% task success. Financial analysis, portfolio management, and investment strategy workflows exhibit reproducible failure patterns that require domain-specific alternatives.

Limited multi-step orchestration: The model handles simple, single-action tasks. Complex sequences compound the 37% tool error rate across each step. Five-step workflows face an exponential failure probability.

No published safety benchmarks: Missing ToxiGen, BOLD, and TruthfulQA scores. Unknown bias patterns and hallucination rates create compliance gaps for regulated industries requiring documented safety validation.

Tool selection variance by domain: Healthcare and Insurance shows TSQ of 0.65-0.68, while Investment shows 0.88-0.90. Inconsistent tool routing accuracy across verticals complicates unified deployment strategies.

Retry dependency for reliability: The economic case for GPT-4.1-nano assumes retry logic. Without architectural investment in error handling, the 0.380 action completion rate results in unacceptable failure rates in production workflows.

Not suitable for autonomous execution: The 37% tool selection error rate makes unsupervised, autonomous workflows risky. Human-in-the-loop validation or automated checking becomes mandatory for production deployments.